Found this helpful? Share it with peers.

Introduction

Creating an effective compliance monitoring plan is essential for staying ahead of regulatory changes and reducing operational risks. With regulations evolving rapidly, organizations need a structured way to track obligations, assess risks, implement controls, and report consistently.

This guide walks you step by step through how to build a compliance monitoring plan that supports long-term regulatory readiness and a strong compliance culture.

What is Compliance Monitoring?

Before building the plan, it’s important to clarify the concept behind it.

Compliance monitoring is the ongoing process of checking whether a company’s operations, policies, and procedures comply with internal standards and external regulatory requirements. It enables early detection of violations and supports timely remediation, making it a key part of any compliance management system.

Why is Compliance Monitoring Important?

The growing number of regulations, such as the Digital Services Act (DSA), NIST standards, and the Digital Operational Resilience Act (DORA), highlights the increasing need for effective compliance monitoring.

Non-compliance can result in hefty fines and reputational damage, as illustrated by high-profile cases like the Wirecard financial scandal and the Volkswagen emissions scandal. Active compliance monitoring strengthens corporate governance and builds trust among investors, partners, customers, policymakers, and the broader public.

The Goal of Compliance Monitoring

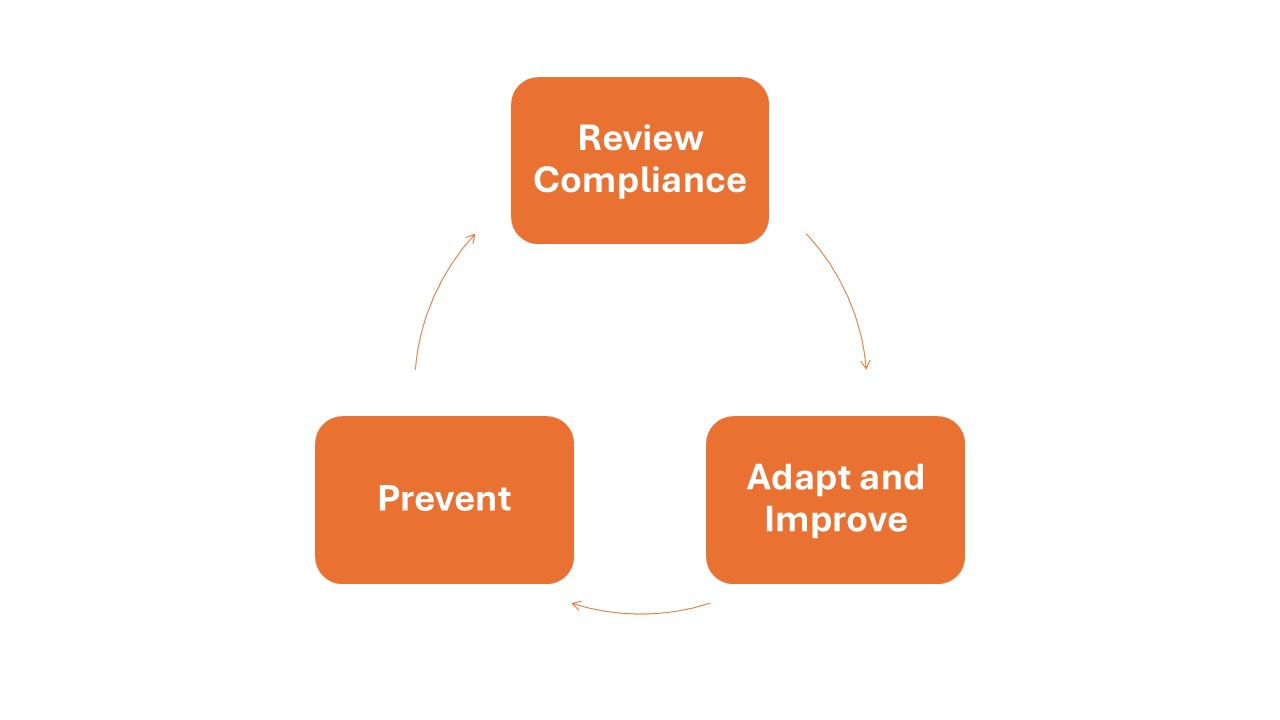

Compliance monitoring aims to enable businesses not just to meet regulations but also to proactively prevent violations and continually enhance quality.

A continuous monitoring cycle, composed of Review, Adapt, and Prevent stages, is particularly effective.

Compliance Monitoring Cycle: Review Compliance, Adapt and Prevent

- Review Compliance: Regular and systematic process reviews ensure all areas of the organization comply with current regulations. This initial step identifies weaknesses and areas for improvement.

- Adapt and Improve: Insights from reviews inform actions to adjust and enhance existing processes, fostering continuous quality improvement and laying the foundation for sustainable compliance.

- Prevent: Adopting a preventive approach significantly reduces the likelihood of future violations. Compliance monitoring ensures processes and controls are updated proactively to prevent issues before they arise.

This cycle helps increase accountability, lower costs through preventive measures, and improve operational efficiency. Organizations can minimize direct oversight efforts by regulatory bodies while enhancing collaboration in public-private partnerships.

Challenges in Compliance Monitoring

Compliance monitoring faces two major challenges: keeping pace with evolving regulations and managing the complexity of multiple requirements. Regulatory demands vary significantly by industry, location, supply chain, and market. Organizations must remain agile to quickly implement new rules and adapt to changes.

Without specialized software solutions, the following difficulties often arise:

- Manual Data Collection and Analysis: Collecting and analyzing compliance data without technical support is time-consuming and error-prone, reducing the accuracy and timeliness of compliance assessments.

- Inconsistent Audits: The quality of audits can vary based on individual expertise, making it hard to establish uniform standards and ensure consistency.

- High Personnel Costs: Monitoring processes require significant manpower without automation, particularly in organizations with complex requirements.

- Lack of Transparency and Documentation: Manual documentation is often incomplete, making reporting and demonstrating compliance to regulators challenging.

These challenges demonstrate that efficient, consistent compliance monitoring is often difficult to achieve without technological support.

6 Steps to Create a Compliance Monitoring Plan

Below is the core of the guide. These steps have been refined and ordered to make them more scan-friendly, actionable, and SEO-friendly, while preserving the substance of your original content.

6 Steps to Compliance Monitoring Plan

1. Conduct a Legal Analysis and Internal Review

Start by understanding what your organization must comply with and how current processes are performing.

-

Identify all relevant laws, regulations, and standards (sector-specific, national, international).

-

Review internal policies, codes of conduct, and corporate standards.

-

Analyze past audits, findings, and known weaknesses.

Goal: create a clear map of regulatory obligations and current compliance gaps.

2. Define Compliance Policies and Standards

Once the regulatory framework is clear, translate it into internal policies and standards.

-

Define concrete policies that reflect regulatory requirements.

-

Ensure they are practical and understandable for operational teams, not just legal.

-

Document compliance criteria and clear responsibilities.

Example:

A pharmaceutical company establishes policies aligned with GMP to ensure all production processes meet regulatory standards. These policies are regularly audited and communicated to staff.

3. Perform a Compliance Risk Assessment

Not all risks carry the same weight. The plan should focus on areas where the impact is highest.

-

Identify compliance risks by business unit, process, or activity.

-

Assess likelihood and impact (fines, reputational damage, operational disruption, etc.).

-

Prioritize high-impact risks to define controls and targeted mitigation actions.

Example:

A financial services firm identifies data protection as a critical risk and prioritizes GDPR-related controls and training to avoid costly penalties and loss of customer trust.

Hint: Explore our expert tips for risk management implementation and learn about its role within the GRC system.

Hint: Learn why compliance risk analysis is essential and how compliance risk management helps you tackle challenges step by step.

4. Embed and Execute Controls

Once risks are prioritized, link them to concrete controls.

-

Design preventive and detective controls (approvals, reviews, segregation of duties, alerts, etc.).

-

Integrate these controls into existing processes and the internal control system.

-

Establish periodic testing to ensure ongoing effectiveness.

Example:

A manufacturing company detects safety non-compliance at a facility and immediately introduces corrective measures such as updated procedures, targeted training, and more frequent safety checks.

5. Train and Educate Employees

A monitoring plan is only effective if employees understand their roles.

-

Develop ongoing training programs on key regulations, risks, and responsibilities.

-

Adapt content to different roles (operations, sales, IT, management, etc.).

-

Reinforce messages through reminders, internal campaigns, and case-based exercises.

Example:

A food production company conducts quarterly training on hygiene standards to ensure compliance and prevent contamination or violations.

6. Monitor, Report and Improve

Finally, your plan needs metrics, reporting, and continuous improvement.

-

Define KPIs (findings count, remediation time, failed controls, etc.).

-

Conduct periodic reviews and internal audits.

-

Document results and share them with management and key stakeholders.

-

Adjust controls and processes based on findings.

Example:

An energy company prepares monthly compliance reports covering violations, incidents, and corrective actions. Leadership uses these insights to prioritize risks and allocate resources.

Hint: Download free checklist and template for your compliance monitoring plan.

Who Is Responsible for Monitoring Compliance?

Responsibility for monitoring compliance typically falls to a company’s compliance department. This department collaborates closely with risk management and senior management to ensure adherence to all regulatory requirements. In smaller companies, the role of compliance oversight may be assigned to other departments, such as legal or finance.

Hint: Watch our free webinar to see how Helvetia Insurance ensures compliance across the entire group by seamlessly integrating risks, controls, and processes.

Manual vs. Software-Based Compliance Monitoring

How you execute the plan has a major impact on effectiveness.

Manual Approaches

-

Increase the risk of human error

-

Are difficult to scale

-

Make reporting slow and inconsistent

-

Create information silos

Software-Based Approaches (Compliance Monitoring System)

-

Automate repetitive tasks (reminders, assessments, reporting)

-

Centralize data and evidence

-

Enable real-time analytics and dashboards

-

Adapt quickly to regulatory changes

Tools like ADOGRC allow organizations to move from spreadsheets and scattered data to a structured, auditable, and automated compliance environment, supported by:

-

standardized workflows

-

libraries of risks and controls

-

monitoring dashboards

-

audit-proof historical records

Compliance Monitoring with ADOGRC

ADOGRC is a comprehensive compliance monitoring tool designed to help businesses efficiently meet their governance, risk, and compliance (GRC) requirements.

Manual data collection and error-prone processes are replaced by automated workflows and real-time analytics. Standardized workflows and a comprehensive compliance library ensure consistent audits and minimize human error. Centralized documentation and dashboards simplify reporting and meet regulatory obligations effectively.

With ADOGRC, businesses are equipped to adapt to regulatory changes flexibly and promote a sustainable, future-ready compliance culture.

Hint: Discover our integrated solution for Compliance.

Summary

A well-structured compliance monitoring plan is essential to manage regulatory risks, avoid penalties, and protect organizational reputation. By following a clear step-by-step approach, from legal analysis and policy definition to risk assessment, controls, training, and reporting, organizations can build a robust and sustainable compliance framework.

With a GRC solution like ADOGRC, compliance monitoring becomes a streamlined, automated, and proactive process that supports long-term governance excellence.