Found this helpful? Share it with peers.

Introduction

In today’s world, where the amount of regulations and laws is constantly increasing, the effective management of compliance risks is a central element of corporate governance. Non-compliance with regulatory requirements can result in significant legal and financial consequences. This is evident in the numerous headlines about companies that have committed compliance violations. Indeed, compliance risks affect every company, whether it is a public, private, for-profit, non-profit, government or federal organization.

Thus, a thorough compliance risk analysis is essential to be best prepared for such incidents. While it does not allow for accurate predictions for the future, it does provide insight into which areas of the business, which processes, and which areas of law are more likely to have compliance violations and where there are fewer risks.

Since a compliance risk analysis is critical to building a robust compliance management system, this blog post will take a closer look at it.

What is compliance risks?

Compliance risks are potential dangers resulting from individual or collective misconduct by employees, executives or the management of a company. These risks manifest themselves in a variety of ways and can affect a company’s reputation, legal liability, and economic stability. Compliance violations can result in significant financial damage, including fines, loss of reputation, and claims for damages.

To successfully counter compliance violations, a comprehensive risk analysis is therefore crucial. It forms the basis of a sustainable and effective compliance program. Without a compliance risk analysis, companies run the risk of setting the wrong priorities, taking ineffective measures and overlooking relevant risks. Compliance risk analysis should ideally be performed at the beginning of a company’s compliance efforts. It involves three basic steps: identifying risks, assessing their impact, and deriving measures to minimize those risks. Let’s take a closer look at each of these steps in the following sections.

What is compliance risk in Business

Compliance risk in business encompasses the potential threats a company faces when it fails to meet its obligations under laws, regulations, industry standards, or internal policies. Unlike risks stemming from intentional misconduct or ethical violations, compliance risk often arises from oversights, mismanagement, or systemic gaps in adhering to mandatory requirements. These risks can vary widely depending on the industry, ranging from breaches of data protection laws (such as GDPR) to failing to meet environmental standards, health and safety requirements, or anti-money laundering regulations.

What makes compliance risks particularly critical in business is their cascading impact. A single instance of non-compliance can lead to fines, loss of operational licenses, and strained relationships with regulators or stakeholders. Beyond financial penalties, companies may suffer reputational damage, which can be harder to repair and may result in lost business opportunities or diminished customer trust. For example, in industries like finance, healthcare, or technology, where consumer data protection and operational transparency are paramount, even a minor regulatory infraction can have long-term repercussions.

Addressing compliance risk in business requires more than just reactive measures. A proactive approach involves embedding compliance into the company’s culture and processes. This includes continuously monitoring the regulatory landscape, ensuring robust training for employees, and utilizing compliance management tools to track and audit adherence. By doing so, businesses not only minimize the risk of penalties but also position themselves as trustworthy and responsible players in their industries.

Compliance risk identification

Compliance risk identification is the process of recognizing and evaluating areas where an organization might fail to meet legal, regulatory, or internal obligations. This critical step ensures businesses can proactively address vulnerabilities, avoiding penalties, financial losses, and reputational damage.

The process begins by mapping applicable laws, industry regulations, and internal policies to identify potential compliance gaps. Collaboration across departments like legal, HR, finance, and operations is essential to uncover risks specific to different areas of the business. External consultants can also offer valuable insights into overlooked vulnerabilities.

Utilizing compliance tools such as ADOGRC, and technology helps streamline risk identification by tracking regulatory changes, flagging issues, and analyzing trends. Regular audits, employee feedback, and monitoring of third-party vendors are also vital components.

Since regulations and business environments are constantly evolving, compliance risk identification must be an ongoing effort. By continuously monitoring risks and adapting, organizations can build a robust compliance framework that supports sustainable operations and protects their reputation.

How to mitigate compliance risk in 3 Steps

Step 1- Compliance risk identification

Compliance risks extend across various areas of law, regulations, and ethical and moral principles, such as those set out in a company’s code of conduct. However, the exact nature of these risks varies from company to company. Particular attention should be paid to areas of law that are frequently associated with high risks of damage. These include, for example, data protection, IT security, corruption and fraud, export control, labor law, environmental protection, and antitrust and competition law.

In practice, both legal catalogs and internal documents such as annual reports or audit reports are used to identify compliance risks and obtain an initial overview. This initial overview of all relevant compliance risks should then be validated and expanded through interviews and workshops with the operating units. Ensure that there is accurate and clear documentation of identified risks from the outset. This will reduce future effort and facilitate regular revision of the risk list. With a well-maintained database, it’s also easy to create compelling reports and comprehensive analytics. GRC-Tools such as ADOGRC can be of great help.

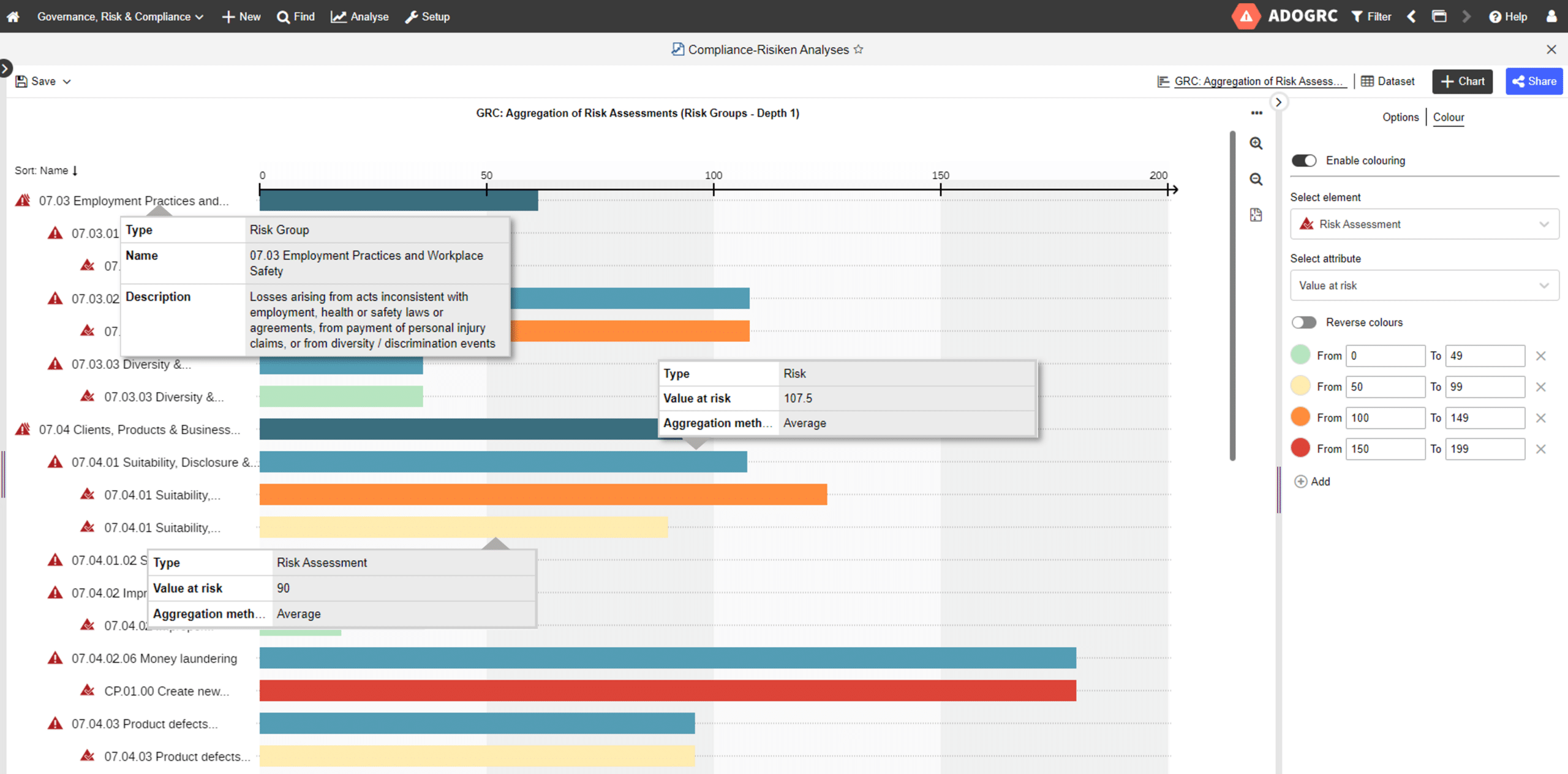

Example of a Compliance-Risk Analysis in the GRC suite ADOGRC

Once the list of compliance risks is considered complete for the time being, the next step is to assess them. But more on this in the next section.

Step 2- Implement a compliance risk assessment program

The second step is the assessment of the identified risks. This involves analyzing the compliance risks in terms of their likelihood of occurrence and potential loss. Companies choose between a quantitative and a qualitative risk assessment.

Quantitative Risk Assessment

The quantitative assessment determines the potential loss in euros and estimates the probability of occurrence for each risk. Typically, the quantitative assessment is performed once without consideration of controls (gross assessment) and once with consideration of controls (net assessment). The quantitative assessment method is also recommended in IDW PS 980, an auditing standard of the Institute of Public Auditors. However, it must be taken into account that the damage caused by compliance violations is often difficult to quantify, especially damage to reputation.

Qualitative Risk Assessment

Qualitative assessment classifies risks according to certain criteria, such as traffic light logic (green, amber and red). It provides a rough assessment of risks and is particularly helpful when quantitative data is difficult to obtain or reputational damage is difficult to estimate.

It is important that compliance risks are assessed at periodic intervals. Because risks can change over time, the probability of occurrence and the amount of damage may need to be adjusted.

Step 3- Compliance risks mitigation

Once compliance risks have been identified and assessed, a clear management strategy should be developed for each identified compliance risk. Should the risk be reduced, accepted, transferred, or avoided?

Then define appropriate initiatives to mitigate the risk and strengthen compliance. Companies often rely on initiatives such as compliance training, policies, internal communication campaigns, or internal controls. First, review what internal controls you already have in place to protect against compliance risks. Go through your existing policies and risk management systems and periodically test how effective and efficient these controls are. This will allow you to build on what you have in place and only need to address any compliance gaps that are uncovered. It is also a good idea to obtain confirmations that controls have been executed. This will ensure that the required controls are properly performed.

Key Components of a Compliance risk management plan

A compliance risk management plan is a structured approach that organizations use to identify, assess, mitigate, and monitor compliance risks. This plan ensures that the organization adheres to legal, regulatory, and internal standards, thereby avoiding penalties, legal issues, and reputational damage.

Risk Assessment:

Evaluate the identified risks in terms of their likelihood and potential impact on the organization.

Mitigation Strategies:

Develop and implement strategies to mitigate identified risks, such as policy updates, employee training programs, and internal controls.

Monitoring and Reporting:

Establish processes for ongoing monitoring of compliance activities and regular reporting to senior management and the board of directors.

Incident Response Plan:

Create a response plan for addressing compliance breaches, including investigation procedures, corrective actions, and communication protocols.

Continuous Improvement:

Regularly review and update the compliance risk management plan to reflect changes in regulations, business operations, and risk landscape.

Legal and Regulatory Adherence:

Ensures that the organization complies with all relevant laws and regulations, reducing the risk of legal penalties and fines.

Reputation Protection:

Helps maintain the organization’s reputation by preventing compliance breaches that could lead to publicized incidents.

Operational Efficiency:

Improves operational efficiency by integrating compliance into everyday business processes and reducing the likelihood of disruptions.

A compliance risk management plan is essential for proactively managing compliance risks, safeguarding the organization’s legal standing, and enhancing its operational integrity.

Risk and compliance best practices

Risk and compliance best practices are essential guidelines and strategies that organizations follow to effectively manage risks and ensure compliance with legal and regulatory requirements. These practices help safeguard the organization’s integrity, reputation, and operational efficiency.

Establish a Risk Management Framework:

Develop a comprehensive risk management framework that includes policies, procedures, and tools for identifying, assessing, and mitigating risks.

Ensure the framework is aligned with industry standards and regulatory requirements.

Implement Robust Compliance Programs:

Create and maintain detailed compliance programs that cover all relevant laws, regulations, and internal policies.

Regularly update these programs to reflect changes in the regulatory environment.

Conduct Regular Risk Assessments:

Perform periodic risk assessments to identify potential risks and evaluate their impact on the organization.

Use the results to prioritize risk mitigation efforts and allocate resources effectively.

Foster a Compliance Culture:

Promote a culture of compliance throughout the organization by ensuring that all employees understand the importance of adhering to regulatory and internal standards.

Provide ongoing training and education to keep staff informed about compliance requirements and best practices.

Establish Strong Internal Controls:

Implement internal controls to monitor compliance and manage risks proactively.

Regularly test and review these controls to ensure their effectiveness.

Effective Communication and Reporting:

Maintain transparent communication channels to report compliance issues and risks to senior management and the board.

Use dashboards and reporting tools to provide real-time visibility into compliance status and risk exposure.

Leverage Technology:

Utilize technology solutions such as compliance management systems and risk assessment tools to streamline compliance processes and enhance risk management capabilities.

Continuous Improvement:

Regularly review and improve risk and compliance strategies to adapt to new risks, regulatory changes, and business developments.

Learn from past incidents and integrate lessons learned into the compliance program.

In conclusion, adopting these best practices helps organizations effectively manage risks, ensure compliance, and sustain a culture of accountability and integrity.

Summary

As regulatory requirements continue to increase, effective compliance management has become a critical success factor for organizations. Compliance risks affect every organization, regardless of size or type. Compliance breaches that result in significant financial damage are not uncommon. To be best prepared for such incidents, a careful compliance risk analysis is essential. It is the foundation of a successful compliance program and serves the following purposes:

- Identification of key risks

- Adaptation of the compliance program

- Development of internal control mechanisms

- Appropriate allocation of resources

- Evidence and documentation to mitigate liability

Incorporating these steps into a regular and comprehensive compliance risk analysis ensures that organizations not only meet legal and regulatory requirements but also protect their financial stability and reputation. By proactively identifying, assessing, and mitigating compliance risks, businesses can foster long-term success and sustainable corporate governance, reducing the likelihood of costly breaches and maintaining the trust of stakeholders.