Found this helpful? Share it with peers.

Introduction

Processes are an integral and value-adding part of companies. They are cross-functional activities whose handling is the responsibility of different competences and whose control can become complex and unmanageable with increasing numbers. Even minimal deviations within a work process can hinder proper execution and influence other work processes. Consequently, compliance with the proper execution of business processes has a high priority in companies. An internal control system (ICS) helps and ensures correct execution of work performance. It is seen as a control and monitoring system of risks in order to prevent possible damage to the company.

The internal control system is often seen as a time-consuming and bureaucratic management tool. However, in addition to the fulfilment of legal requirements, appropriate documentation and regular review of the ICS have become essential, especially for the sustainable safeguarding of the company’s existence. Moreover, it contributes directly to increasing the effectiveness and efficiency of business operations.

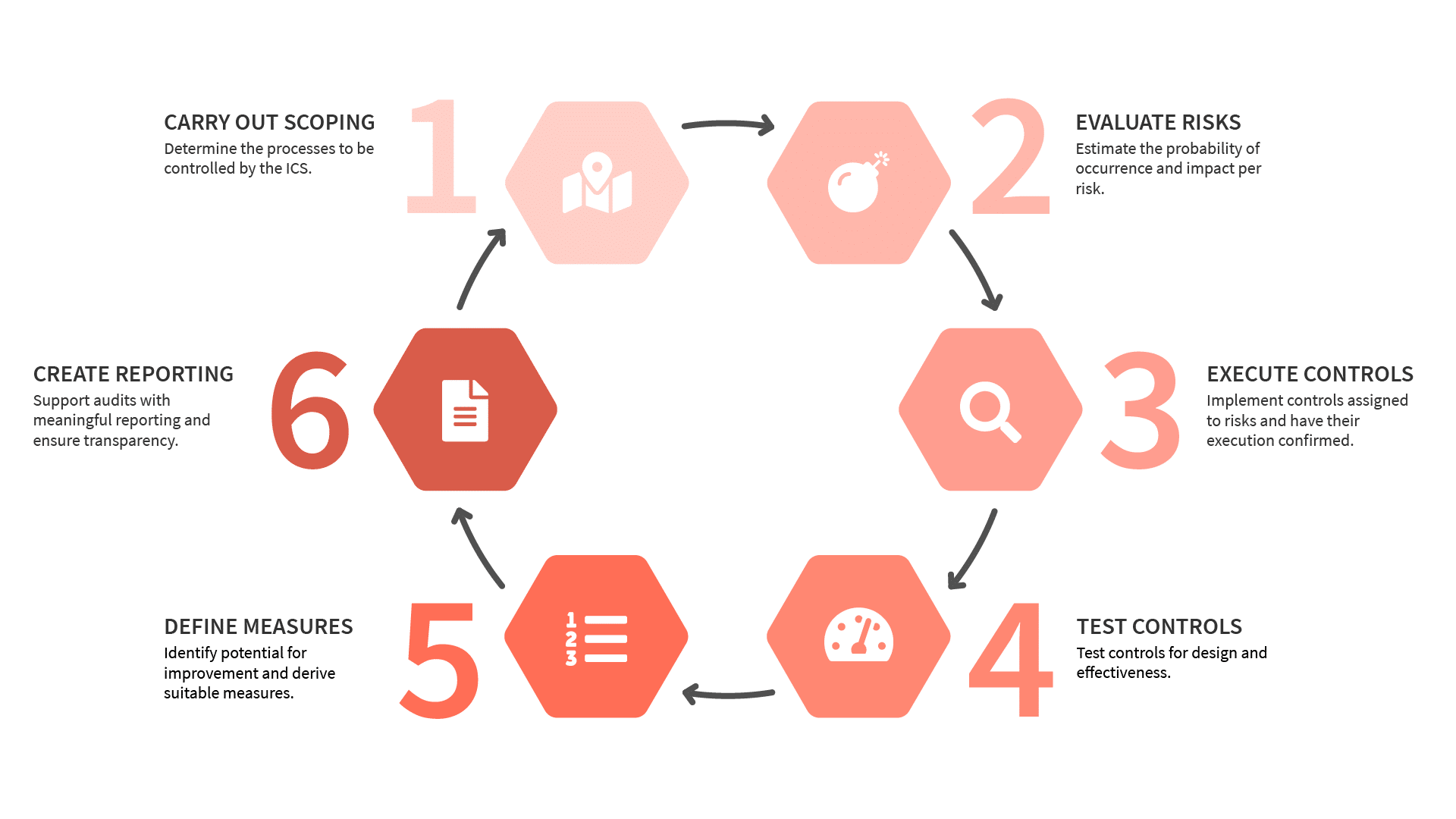

We would like to show you how to implement your ICS in six simple steps. You can also find an immediately available and detailed description of the individual steps in our whitepaper about how to following processes.

What is an Internal Control System?

An internal control system internal control system is understood to be the totality of all processes, methods and measures of an organization that are aimed at ensuring proper operational processes and preventing damage. The focus is on ensuring the achievement of business objectives while complying with requirements regarding effectiveness and efficiency, correctness of financial reporting and compliance with legal framework conditions.

Hint: Streamline your compliance strategy with compliance risk management in 3 essential steps.

A procedure model for the introduction of your ICS in six steps.

If the internal control system is well embedded in the company, it can be operated with little effort and still deliver the required effectiveness.

With the following six steps, you are guaranteed to succeed in implementing your ICS:

Image 1: The procedure model for the introduction of an internal control system (ICS)

If you want to learn more about the individual phases, you can download a detailed description of the process model in PDF-format for free.