Found this helpful? Share it with peers.

Introduction

Sustainability is no longer a buzzword; it’s a global imperative. Recognizing the critical role of business in shaping a sustainable future, the European Union has introduced the European Sustainability Reporting Standards (ESRS).

In this comprehensive blog post, we aim to answer all your questions about ESRS, from its basic definition to its implications for businesses.

What are the European Sustainability Reporting Standards?

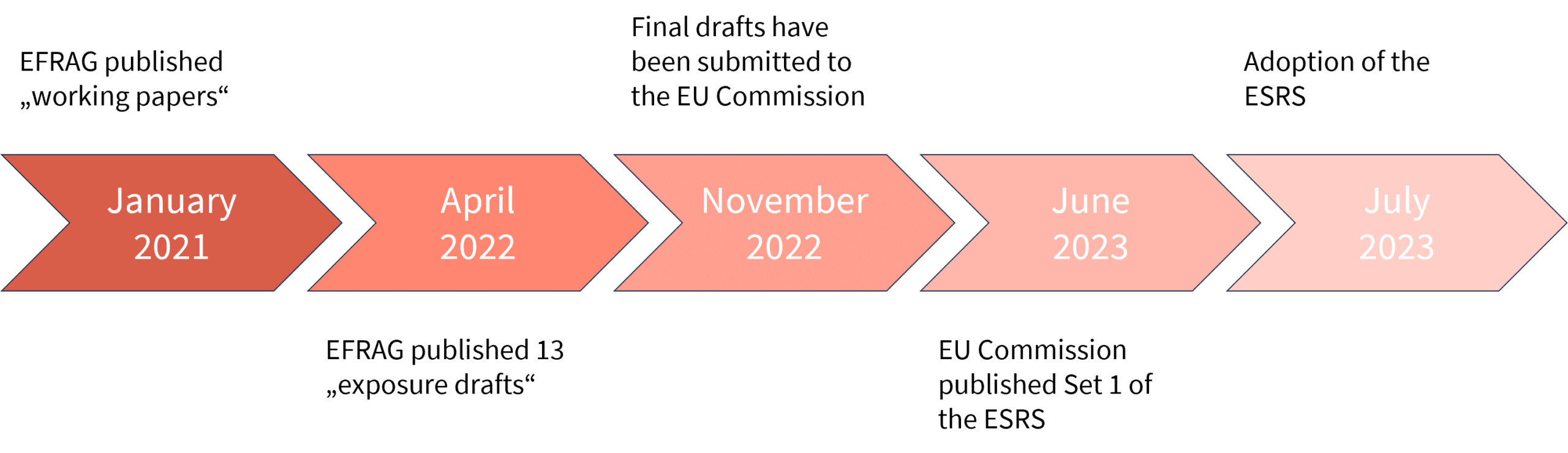

ESRS, or European Sustainability Reporting Standards, are a set of guidelines developed by the European Financial Reporting Advisory Group (EFRAG) to standardize sustainability reporting practices across the European Union. These standards are designed to provide a clear framework for companies to disclose non-financial information, enabling stakeholders to assess their environmental, social, and governance (ESG) performance. The following figure shows the process of creating the ESRS:

Timeline of ESRS Development

What is the difference between ESG and ESRS?

Understandably, people often get confused when it comes to the terms ESG and ESRS. So let us briefly explain the difference: ESG, or Environmental, Social, and Governance, is a broader framework that encompasses the overall sustainability performance of a company. On the other hand, ESRS focuses specifically on the reporting standards that guide companies in disclosing their sustainability practices. In essence, ESG is the broader concept, while ESRS is the tool that helps companies communicate their ESG efforts effectively. Now, let’s take a closer look at ESRS.

What will the EFRAG sustainability reporting standards mean for businesses?

The introduction of sustainability reporting standards marks a significant change for companies operating in the EU. The Corporate Sustainability Reporting Directive (CSRD) will now require companies to provide a more comprehensive and transparent account of their sustainability and social practices. This move isn’t just about compliance; it’s about fostering a culture of responsible corporate citizenship. Companies will need to integrate sustainability considerations into their core strategies and demonstrate their commitment to long-term environmental and social responsibility.

European Commission

Which companies will the EU sustainability reporting standards apply to?

ESRS applies to all large and listed companies, except from micro-enterprises. The criteria for applicability is based on factors such as size, turnover, and the number of employees. Companies meeting two of the following three conditions will have to comply with the CSRD:

- More than 40 million EUR in net turnover

- More than 20 million EUR in assets

- 250 or more employees

In total, almost 50,000 EU companies will be affected and will have to report on their environmental, social and governance impacts.

Are the EU ESRS mandatory? When will companies have to use them?

One of the fundamental questions surrounding the European Sustainability Reporting Standards (ESRS) is whether they are mandatory for businesses operating within the European Union. The answer is unequivocally YES. ESRS is not a voluntary set of guidelines; it represents a regulatory framework that companies, which fulfill two of the three criteria mentioned, must adhere to. The first wave of companies will have to start reporting in 2024.

What are the disclosure requirements included in the ESRS?

ESRS comprises a set of disclosure requirements that companies must adhere to when reporting their sustainability performance. These requirements cover a range of topics, including environmental impact, social responsibility, and governance practices. The goal is to provide a holistic view of a company’s sustainability efforts, allowing stakeholders to make informed decisions based on a comprehensive understanding of its impact on the planet and society.

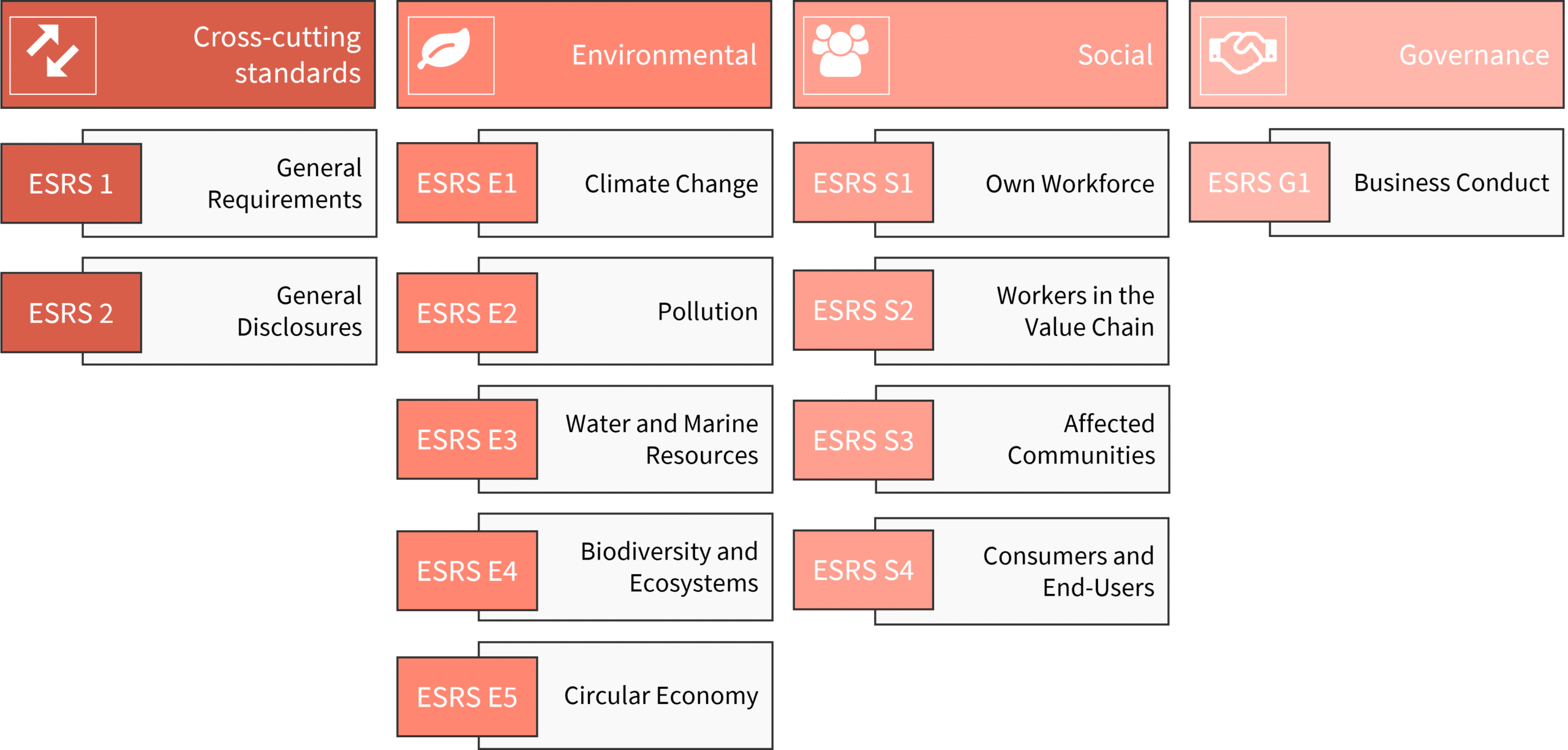

There are two main standards covering general requirements and formal rules for reporting (ESRS1) and broad disclosure requirements (ESRS2), asking for basic company data and cross-cutting information about the company’s sustainability governance and strategy. This standard also requires reporting on how sustainability impacts, risks and opportunities are identified, what policies and initiatives are applied, and what targets and indicators are used to manage and monitor progress. Additionally, ten more standards (thematic ESRS standards) focus on detailed disclosure needs across environmental, social, and governance areas.

Overview of the 12 ESRS Standards

Altogether, these twelve standards make it mandatory for companies to share information on:

- Governance and strategy: Companies need to explain how they’re organized and share strategies for addressing material sustainability issues.

- Impacts, risks and opportunities: It’s important to outline the impacts, potential risks, and new opportunities associated with identified sustainability topics.

- Quantitative metrics and targets: The ESRS require the inclusion of specific metrics and targets that provide a clear way to measure and evaluate sustainability performance.

Which topics actually need to be disclosed in the sustainability report?

This is where the concept of Double Materiality comes into play and assumes a critical role.

ESRS 1 and ESRS 2 are essential universal standards, obligatory regardless of materiality assessment outcomes. The remaining 10, known as topical standards, are disclosed only if considered material, based on the Double Materiality Assessment (DMA) results.

The Double Materiality Analysis therefore serves to precisely identify relevant sustainability topics for your company, guiding their inclusion in the sustainability report. A robust process, and the resulting analysis are pivotal for the company’s compliance with CSRD and, consequently, its adherence to ESG standards.

Hint: Use our free template for double materiality assessment to identify impacts, risks, and opportunities based on a predefined evaluation logic.

Summary

In conclusion, the European Sustainability Reporting Standards (ESRS) represent a major shift in global business towards sustainability. ESRS is a mandatory framework that challenges nearly 50,000 EU companies to integrate sustainability into their core strategies. As the first wave of reporting approaches in 2024, ESRS is not just about compliance, but represents a transformative journey towards sustainability-driven business. This framework ensures that companies provide transparent and comprehensive non-financial information, fostering a culture of long-term responsibility and contributing to a more resilient and sustainable world.

Your Next Steps

Grab our complimentary poster below, outlining the 6 essential ESG steps for clear insight into your obligations and actionable next steps.

To propel your sustainability journey forward, we recommend exploring our blog on Double Materiality assessment. Gain insights into the crucial aspects of the analysis, learn how to identify relevant topics for your company and make informed decisions on their inclusion in your sustainability report.