Introduction

We all wish from time to time, that we lived in a perfect world, where everything would simply go according to plan. Unfortunately, our reality is a bit more unpredictable and disruptive than that – exposing businesses to continuous changes and unexpected events that alter our plans and create high uncertainty. So, what can a company do to minimize the negative impact of such events, or even prevent them from occurring in the first place?

The answer lies in one effective, safeguarding mechanism: implementation of internal controls, or more precisely establishment of an internal control system. What are internal controls exactly, how they work, and how you can use them to your benefit are just few of the insights we’ll be exploring in this blog post. So dive deeper with us and learn all the ICS basics you need to know!

What is an internal control system?

An internal control system is a formal system of policies and procedures that helps an organization achieve its objectives effectively. The system is designed to protect the organization’s assets, prevent mismanagement, and ensure that employees are adequately following the established rules and procedures.

What are internal controls?

Internal controls refer to all mechanisms and activities that are designed to help a company operate efficiently and effectively. These typically include specifications, guidelines, rules, management declarations, and more.

Different types of internal controls

Internal controls can be divided into two sub-categories – depending on the effectiveness and possibilities in each specific context.

Preventive controls

Preventive controls play an important part in an ICS because they help prevent errors or irregularities from occurring in the first place. These controls are put into effect to proactively address potential risks and issues, rather than just reacting to them after they have already happened.

Some common examples of preventive controls include:

1-Segregation of duties:

This involves dividing tasks and responsibilities among different individuals within an organization to prevent a single person from having too much control over a particular process. Such a split can help prevent errors or fraud, because it makes it more difficult for one person to manipulate the system without being detected.

2-Authorization and approval processes:

This involves setting up rules and procedures for how transactions and other business activities are authorized and approved. The measure ensures that only authorized individuals can make decisions and take actions on behalf of the organization.

3-Physical controls:

Physical controls prevent unauthorized access to assets or information. This can include things such as locks, security cameras, and other measures to protect the organization’s premises and assets.

4-Information technology controls:

These are controls that focus on preventing errors or irregularities in the organization’s IT systems. Typical examples might be password policies, data backup and recovery procedures, and any other measures to protect the organization’s IT infrastructure.

Detective controls

Detective controls are initiated after any activity in order to identify errors, fraud, and other irregularities within an organization. These controls typically involve the use of various monitoring and reporting tools to discover potential issues, such as discrepancies in financial records or deviations from established policies and procedures.

Four examples of detective controls include:

1-Auditing:

Regular audits are used to review an organization’s financial records and transactions to identify errors or inconsistencies.

2-Fraud detection systems:

Internal or external fraud detection systems can be used to monitor transactions and identify potential instances of fraud.

3-Security monitoring:

Tools such as intrusion detection systems and security cameras can be used to monitor an organization’s physical premises and detect potential security breaches.

4-Exception reporting:

Automated reports that flag deviations from established policies and procedures can help to identify potential issues and areas for improvement.

Why is an internal control system important?

An internal control system is a vital component of any company’s long-term success, as it not only protects the company’s assets from illegal or unauthorized access, but also ensures the accuracy and reliability of financial information.

This makes ICS an essential asset for good decision making and reporting. What’s more, an internal control system helps to ensure proper compliance with laws and regulations and reduce the likelihood of fraud. So altogether, an ICS enables the organization to be more efficient and cost-effective in its operation.

It’s also worth noting, that an internal control system is not a legal requirement for every organization. For instance, financial institutions, public accounting firms, and government agencies are strictly required to have one. Other organizations may choose to implement an internal control system as part of their risk management strategy and thus take advantage of its manifold benefits.

The main tasks and goals of an internal control system

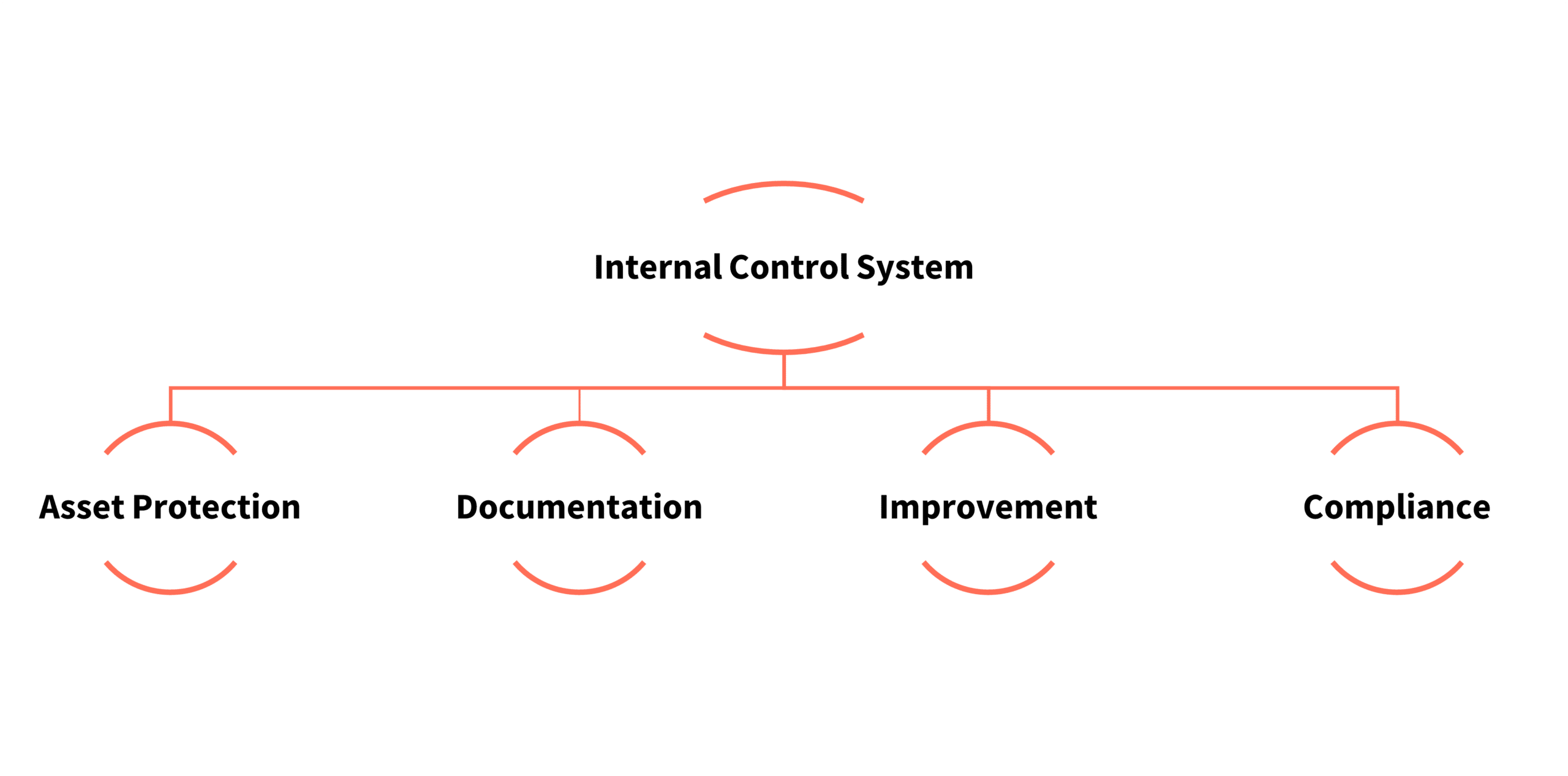

An internal control system is a valuable tool for businesses of all sizes. Ensuring smooth operation of internal processes and preventing corruption should be of high importance to every organization. Thus, the main tasks and objectives of an ICS can be broken down into four main categories: asset protection, documentation, improvement and compliance.

Here’s how it works:

Asset Protection:

ICS helps to safeguard businesses against losses by providing visibility into existing assets. This allows the company to quickly identify any potential risks and take action to prevent losses.

Documentation:

ICS helps to ensure that all processes are recorded accurately and in a timely manner. This helps to ensure that all parties involved are aware of any changes and that the records are up-to-date.

Improvement:

With the help of ICS, businesses can easily identify areas of improvement and make necessary changes. By having access to all the records, businesses can quickly identify any discrepancies and take corrective action.

Compliance:

ICS helps to ensure that all parties involved are following regulations and guidelines. This helps to reduce the risk of non-compliance, which can lead to costly fines and penalties.

Benefits of an internal control system

Broadly speaking, investing in the right controls to ensure a sustainable operation of your organization in the long run is a must.

Not only does this guarantee business continuity and protect your organization from costly errors and fraud, but it also creates added transparency, helps identify problems early on and allows for adequate corrective action.

Finally, internal controls promote boosts in employee productivity, maintain regulatory compliance, uphold your organization’s reputation and brand value, and help retain your customers – which in and of itself should be enough of an incentive to get your ICS under way today!

Challenges of an internal control system

Due to the complexity of different moving parts in your organization, implementing an effective internal control system is not always an easy task. It can be challenging to identify the potential risks and develop strategies to mitigate them, as well as ensure that all employees are aware and follow the procedures put in place by the ICS.

Another obstacle for a successful ICS operation is the ever-changing business environment. As technology evolves, it becomes necessary to update and modify your internal controls accordingly.

Nevertheless, this is where an internal control system software comes in to save the day. Supporting your ICS initiatives with a suitable tool, makes any challenges significantly easier and the implementation of proper measures much more efficient. If you’re wondering how to select the most fitting tool for your business, be sure to check out our blog post to check out our blog post on internal control system software.

Summary

Internal control system is essential for any organization looking to effectively manage risk and ensure the integrity of its operations. By establishing clear policies and procedures, training employees on best practices, and regularly revisiting existing controls, companies can create a strong foundation for long-term business success.

While implementing an ICS may require an initial investment of time and resources, the long-term benefits far outweigh any costs. An effective internal control system helps to protect your organization’s assets, ensures compliance with laws and regulations, and ultimately increases your company’s efficiency and profitability. This makes a well-designed internal control system an indispensable asset of any successful organization.

If you’d like to continue your exploration of internal control systems, be sure to browse our resources collection below, or directly get in touch with our team to get guided support for your ICS journey!

Get our weekly updates.

Never miss the freshest content.