Introduction

In today’s business world, it is no longer just about sales and profits. More and more companies are realizing that their responsibilities extend beyond their own four walls. ESG – Environmental, Social, Governance – is the buzzword that has grown in importance in recent years. ESG represents the three fundamental sustainability-related areas of responsibility of companies and is seen as critical to a company’s growth, resilience, and competitiveness.

But how can companies ensure they are on the right track? Having a clear and well-documented sustainability strategy is certainly a good start. However, in the pursuit of sustainability and reputation, companies must also actively address the risks associated with ESG issues and, most importantly, integrate them appropriately into their processes.

In this blog post, we take a closer look at why ESG risk management is essential for sustainable success in a rapidly changing business world and how you can incorporate ESG risks into your risk portfolio.

What are the 3 essential pillars of ESG?

ESG consists of three pillars: environmental, social and corporate governance. Companies are expected to understand the environmental, economic and social impacts of their business activities and align them with the requirements of sustainable development. Issues such as transparency and sustainability are in the spotlight today and are seen as critical to growth, opportunities, resilience and competitiveness.

If you would like to delve deeper into the topic of ESG at this point, we recommend that you take a look at our blog post Environmental, Social and Governance (ESG). There you will find not only a detailed explanation of the individual ESG pillars (also called sustainability factors), but also other background information that will be relevant for (specific) companies in the future.

What does ESG risk mean?

In addition to the three ESG pillars mentioned above, there are the so-called ESG risks (also called sustainability risks). These are defined in the FMA Guidelines as follows:

FMA Guideline on the Scope of Sustainability Risks

As described in the FMA Guidelines, ESG risks can have an impact on a company’s business, reputation and financial stability. It is therefore essential for companies to understand, identify, assess and monitor these risks on an ongoing basis. Basic examples of ESG risks include an increase in natural disasters, social injustice, or corporate governance issues.

What is ESG risk management?

The challenge with ESG risks is that they are not fundamentally a separate risk category. Rather, they are cross-cutting risks that affect all risk types in different ways. Sustainability risks should therefore be classified under the existing risk types and appropriately integrated into risk management. It is also necessary to review the entire risk management system for possible adjustments.

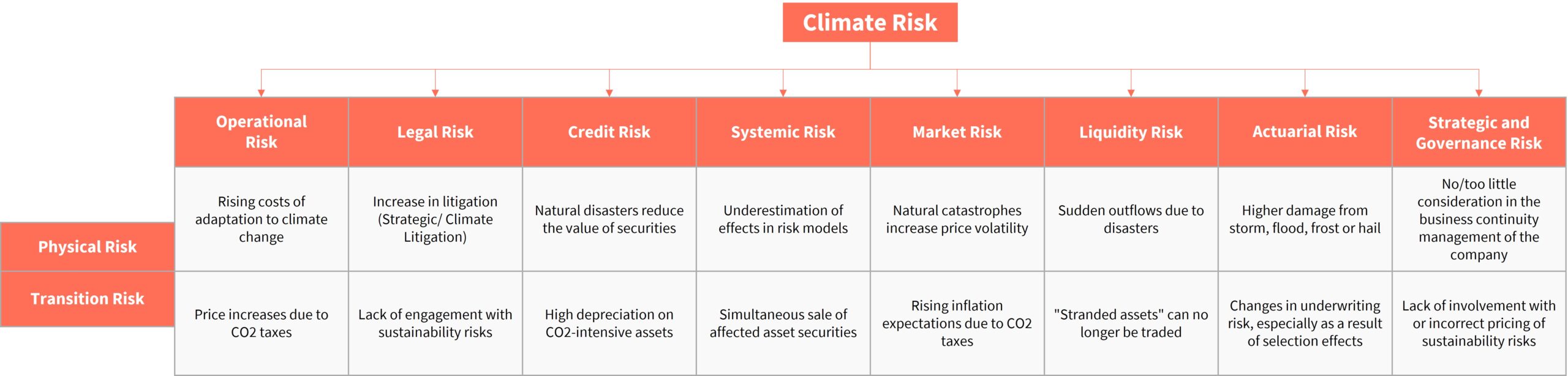

Let’s take a closer look at ESG risks using climate risks as an example. The following figure shows the impact of climate risks across eight risk categories: operational risks, legal risks, credit risks, systemic risks, market risks, liquidity risks, actuarial risks, and strategic and governance risks.

Example of a risk classification of the ESG climate risk

Climate risks can generally be understood as all risks that are either caused or amplified by climate change. Climate risks can be further divided into two risk categories: physical risks and transition risks.

Physical risks arise from the effects of climate change. Extreme weather events such as hail, rising temperatures, heat waves and droughts play an important role. The earlier climate protection measures are taken, the lower the probability of physical risks occurring and the smaller the losses. On the other hand, there are transition risks that arise from the transition to a climate-neutral economy and society. These can affect the legal and economic framework and, for example, the introduction of a CO2 tax can have a significant impact on the risk.

Why are ESG risks important in risk management?

As the previous example shows, ESG issues can pose significant risks to companies. By integrating ESG issues into risk management, companies can more effectively identify and manage ESG risks, reduce their impact and thus improve their overall risk profile. Therefore, in order to identify relevant risks and potential opportunities, companies should consider the complexity of ESG risks at an early stage and undertake a thorough risk analysis and integration into their existing risk portfolio. Companies need to carefully consider which ESG risks may negatively impact future processes, how this changes the company’s risk profile, and the implications for risk management. In general, companies that prioritize ESG risk management are better positioned to achieve sustainability and long-term success.

How to integrate ESG risks into risk management?

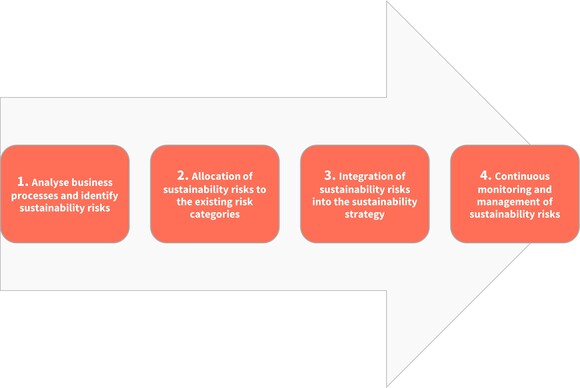

Now that the terminology has been clarified and a common understanding of ESG risks and their importance for companies has been established, the question naturally arises as to how exactly sustainability risks can be integrated into risk management. BOC Group recommends a 4-step approach as shown in the graphic below.

- Analyse business processes and identify sustainability risks

- Allocate sustainability risks to the existing risk categories

- Integrate sustainability risks into the sustainability strategy

- Continuously monitor and manage sustainability risks

BOC Group’s 4-step approach to integrating ESG risks into risk management.

Conclusion

In summary, ESG is playing an increasingly important role in corporate risk management. To ensure long-term success and fulfill their responsibilities towards the society and the environment, companies should integrate ESG factors into their risk management following our recommended 4-step approach.

Check out our free webinar and get more insights on how to best approach ESG risks and effectively integrate them in your risk portfolio. If you want to get support with your ESG strategy or simply chat on the topic of ESG risks with our experts, get in touch and schedule a 15-minute call with our team.

Get our weekly updates.

Never miss the freshest content.