Introduction

Have you ever heard the term “ESG”? With great certainty! It is currently on everyone’s mind… It’s clear that the sustainability reporting that will be mandatory from 2023 onwards will be the subject of much discussion! The only question that remains is: Is your company already prepared?

No? You don’t know how? And you have not heard of ESG until now? Luckily, you’ve landed here! And don’t worry, in this article you will find all the important info you need to know on this topic for now!

What is Environmental Social Governance ESG?

In the course of the last few years, a rethinking within society on environmental and social issues has become increasingly noticeable. Companies are particularly affected by this. Instead of focusing purely on economic profits, they should increasingly move in the direction of holistic sustainable management and commitment. “Sustainable” is already the buzzword of the hour around which everything revolves when it comes to ESG! But what is behind the three letters?

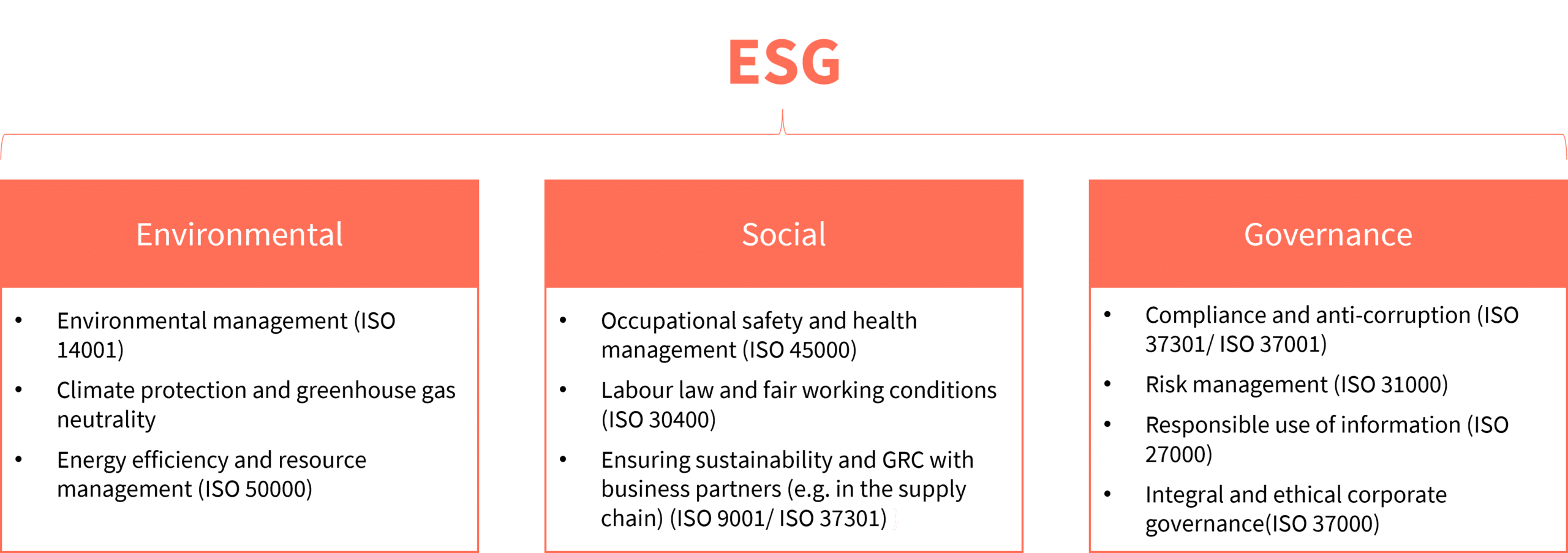

The acronym ESG stands for Environmental, Social and Governance and represents the three fundamental sustainability-related areas of responsibility of companies. With these so-called ESG criteria, it will be possible in the future to evaluate and map the sustainability of a company as well as its contribution to society. Let us first take a brief look at the individual areas of responsibility:

Environmental

The first category of the three ESG criteria focuses on the environmental aspect. More specifically, it is about the reciprocal relationship between business and nature. As you know, your company can have both a positive and a negative impact on the environment through its economic activities. Examples of this would be dealing with climate change, the responsible use of limited resources, reduction of the ecological footprint or even sustainable energy management.

Social

The second category of ESG criteria addresses social issues, such as working conditions and occupational health and safety, respect for human rights and much more.

Governance

The third condition of the ESG criteria is about sustainable and responsible corporate governance. This includes, for example, risk and reputation management, the fight against bribery and corruption or data protection.

Environmental Social Governance (ESG) criteria

When taking a closer look at the ESG criteria, a distinction can also be made between two perspectives. These are the inside-out perspective and the outside-in perspective. The former is about the influences a company has on its environment. The outside-in perspective, on the other hand, refers to the influence of the environment on the company. What they have in common is that they deal with the risks and opportunities of a company.

You may ask why this distinction is important? Well, the issue of sustainability is of course not only about how your company is affected but also about what you do for society. This leads us to the all-important question…

Why is Environmental Social Governance in the spotlight right now?

The background to this is the European Union’s (EU) mandatory sustainability reporting for companies starting in 2023. In addition to an expansion of the scope, all sustainability reports will also be subject to an external audit in the future. Companies that fulfil at least two of the following three size criteria on the balance sheet date will be obliged to report:

- > 250 employees during the business year

- > 20 million EUR balance sheet total

- > 40 million EUR net turnover

It is already known that there will be changes with regard to the reporting format, reporting standards and the scope of the information to be reported. The mandatory disclosure of a sustainability report is intended to put an end to so-called “greenwashing” (the attempt to achieve a “green image” through targeted PR measures). Overall, however, sustainability information should become more comparable, standardized and digitalized. Since the standards according to which reporting is to take place are currently being developed, companies are faced with the following problem in particular: How can you prepare for mandatory reporting? And how can you develop a sustainable ESG strategy?

My answer is: with an integrated Governance, Risk & Compliance (GRC) system!

ESG: How to prepare for the mandatory sustainability reporting

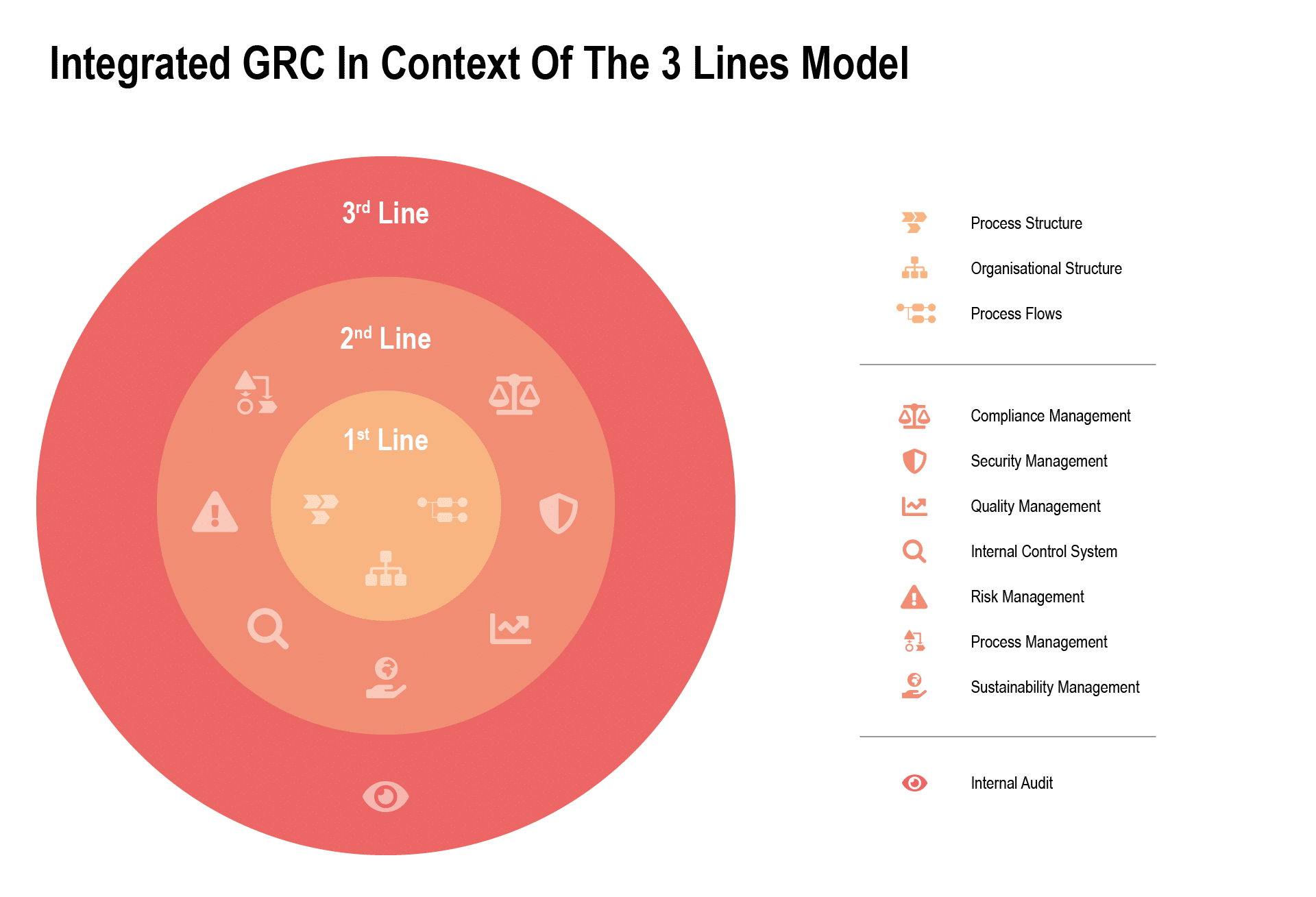

The Governance, Risk & Compliance (GRC) system is a fundamental component of corporate governance. Various management functions such as risk management, compliance management or the internal control system serve to protect the company from risks and at the same time to seize opportunities. In order to fulfil these tasks effectively and efficiently, however, an integrated management system is required (check out our webinar on the topic of integrated GRC systems here). The 3-lines model has proven itself as a basis for this structure (learn more on the 3-lines model in this blog post). It divides an organization into three lines that define the tasks for the operational units, the GRC functions and the monitoring.

Recently, it has become increasingly clear that the topic of ESG is also establishing itself as a management system or governance function in its own right and can thus be classified as part of the three lines model on the 2nd line with active support from the 1st line.

Sustainability as a separate management system in the 3-Lines Model

Summary

ESG goes beyond mere compliance and requires a holistic strategy. Companies that address ESG early on and implement an integrated Governance, Risk & Compliance (GRC) system can not only meet the reporting requirements, but also reap the long-term benefits that sustainable business practices offer. The upcoming mandatory sustainability reporting starting in 2023 presents a challenge, but at the same time an opportunity to steer your own company towards a sustainable future.

Ultimately, ESG stands not only for responsibility towards the environment and society, but also for long-term corporate success and competitiveness in an ever-changing business world. Companies that proactively address this change are well equipped to shape a sustainable future.

Referenced papers

Scherer, J. , (N.A.). Nachhaltigkeits- (ESG-/CSR-) Compliance- und -Risikomanagement – die wesentlichen Pfeiler, auch für Resilienz. Retrieved from: https://www.scherer-grc.net/files/fil/kurzversion-nachhaltigkeits–esg-csr–compliance–und-risiko.pdf

Scherer, J., Romeike, F., Grötsch A., (N.A.). Unternehmensführung 4.0: CSR/ESG, GRC & Digitalisierung integrieren. Retrieved from: https://www.scherer-grc.net/files/fil/integration-management-systeme-final-20210502.pdf

Scherer J., Grötsch A., (N.A.). (Kombi-) Zertifizierung von Compliance-Risiko-Managementsystemen und Komponenten von Nachhaltigkeits- (ESG-) Berichten. Retrived from: https://www.scherer-grc.net/files/fil/esg-schererpdf.pdf

Get our weekly updates.

Never miss the freshest content.