Introduction

The struggle for Enterprise Architects today is real: disruptive markets, pressure for constant change and innovation, a myriad of applications, and the need to accelerate transformation at a faster pace than ever to stay ahead of competition.

These challenges call for quick and steady EA growth and require new ways of management to steer the architecture in a good direction. AI and machine learning could be just the right tools for the job. They’ve already been successfully leveraged in other industries, and now it’s about time they entered the EA game as well – helping you unlock the true power of your Enterprise Architecture data.

If you’re curious how machine learning could turn your EA data into valuable insights for portfolio investment decisions, be sure to keep reading on!

What is Artificial Intelligence (AI)?

As its name implies, Artificial Intelligence is the ability of a machine to simulate human behavior. In particular, when it comes to different implementation methods, machine learning is among the most powerful and pervasive. Imitating the way humans learn, machine learning mechanisms use a collection of data and run it through a certain algorithm to provide information that would otherwise take a long time of manual work. Why is this highly embraced today? Well, it’s mostly about saving time, avoiding mistakes and making the best use of ever-emerging data – and all of this happens in the background, while you are focusing on other important topics.

Machine Learning and Enterprise Architecture

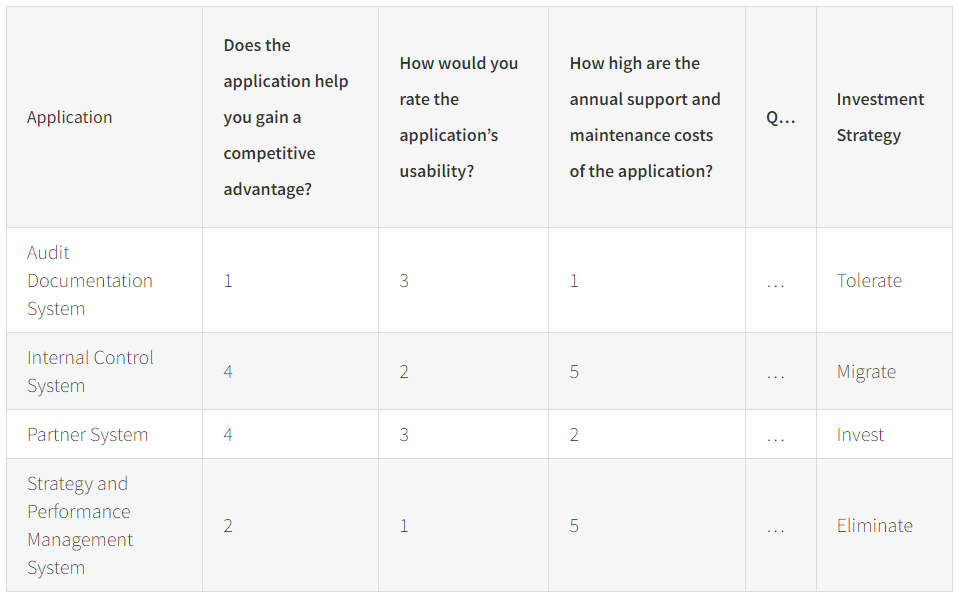

The large number of software applications that accumulate over time can become quite overwhelming for Enterprise Architects to maintain. Such applications can be evaluated using checklists or questionnaires in order to make smart investment decisions. However, while this is a great step to assess your portfolio, analysing each application individually to define an investment strategy can certainly be very time-consuming. And this is where machine learning comes to the rescue. In the following sections, we’ll explore two ways you can easily evaluate your application portfolio with AI.

Keeping Score

Whichever evaluation option you choose for your application portfolio assessment, it will probably be based on some kind of scoring. For instance, if you fill out a survey, each response will typically hold a certain value (for example from 1 to 5). With your final score, you will be able choose an investment strategy that best fits the application at hand. Calculating this score manually, however will probably take you a while, especially if you have a rich application portfolio. Luckily, computers can now do this type of work for us – and in just a fraction of time too. So, the only thing you need to do is set a threshold for each investment strategy, for example following Gartner’s TIME Model approach.

Company Benchmark

Sometimes, though, a proper application assessment requires more than just a simple scoring. Since some criterions are more important than others, you may, for example, decide to invest in a certain application – despite the final score suggesting otherwise. After a few such iterations, the computer will learn the pattern of your investment decisions and start making comparable suggestions of its own. The more applications you assess and prioritize, the more accurate the AI recommendations will become.

The final choice still rests on you: do you trust the computer’s proposal, or would you still like to overrule and adapt the investment decision? In either case, the computer will memorize and adjust its algorithm accordingly. An important factor to note here, is the probability of the computer being right. The machine learning algorithm calculates the probability of the accuracy of its investment strategy proposal. So, for instance, if the probability is less than 35% (meaning that the machine learning did not have enough data to make a qualitative proposal), no investment strategy will be suggested or it won’t be very relevant.

Accuracy of AI Predictions:

- The more responses (data) go through the algorithm, the more accurate the AI predictions will be

- As more responses come in, the machine learning model will consider each question as its own dimension. This means that if a single question response is more important for your evaluation than the others (e.g. the usability of an application), the machine learning model will learn this and apply it when making a prediction

- The main difference between investment strategies based on a manual calculation vs. the machine learning model is that the first is a simple scoring that only considers a final sum. On the other hand, the machine learning model takes the importance of different questions into account and gives more weight to some questions accordingly. In real life, individual cases are often more important than overall scores. So we can naturally expect that ML is more likely to give a more accurate result.

Example Of An Application Portfolio Assessment Using AI And Machine Learning

Let’s say we have a survey that helps us assess our application portfolio based on their business and IT fitness and define a suitable investment strategy. Consider the following sample set of answers (ranging from 1-5):

The machine learning model will try to come up with a weight value for each of these questions by learning the answers and the resulting investment strategy and converting them into patterns. So, let’s say:

- Question 1: Does the application help you gain a competitive advantage?

- Question 2: How would you rate the application’s usability?

Question 1 might be more relevant for your decision than Question 2. Thus, it has a greater weight (W). So, the way the computer will come up with the final decision is by solving something of an equation that might look like this:

Q1xW1 + Q2xW2 + Q3xW3 = Tolerate

Q1xW1 + Q2xW2 + Q3xW3 = Invest

Q1xW1 + Q2xW2 + Q3xW3 = Migrate

Q1xW1 + Q2xW2 + Q3xW3 = Eliminate

Naturally, after a larger amount of data, the weight value will become more accurate and so will the result with your investment suggestion. Ultimately, this will allow you to build future-proof application portfolios with greater ease and less effort.

Summary

As technology advances over time, so should your Enterprise Architecture. Make use of the emerging trends such as machine learning to give your EA data more value and let it help you take important application portfolio decisions. This new way of evaluating your portfolios not only saves you time, resources and reduces errors, but it is also more accurate than common assessment approaches. Whichever benefit is of interest to you, using AI and machine learning for your EA is definitely worth a try.